owe state taxes ny

However while it may differ per state the process will generally. New York state income tax rates are 4 45 525 59 597 633 685 965 103 and 109.

How To File A New York State Tax Return Credit Karma

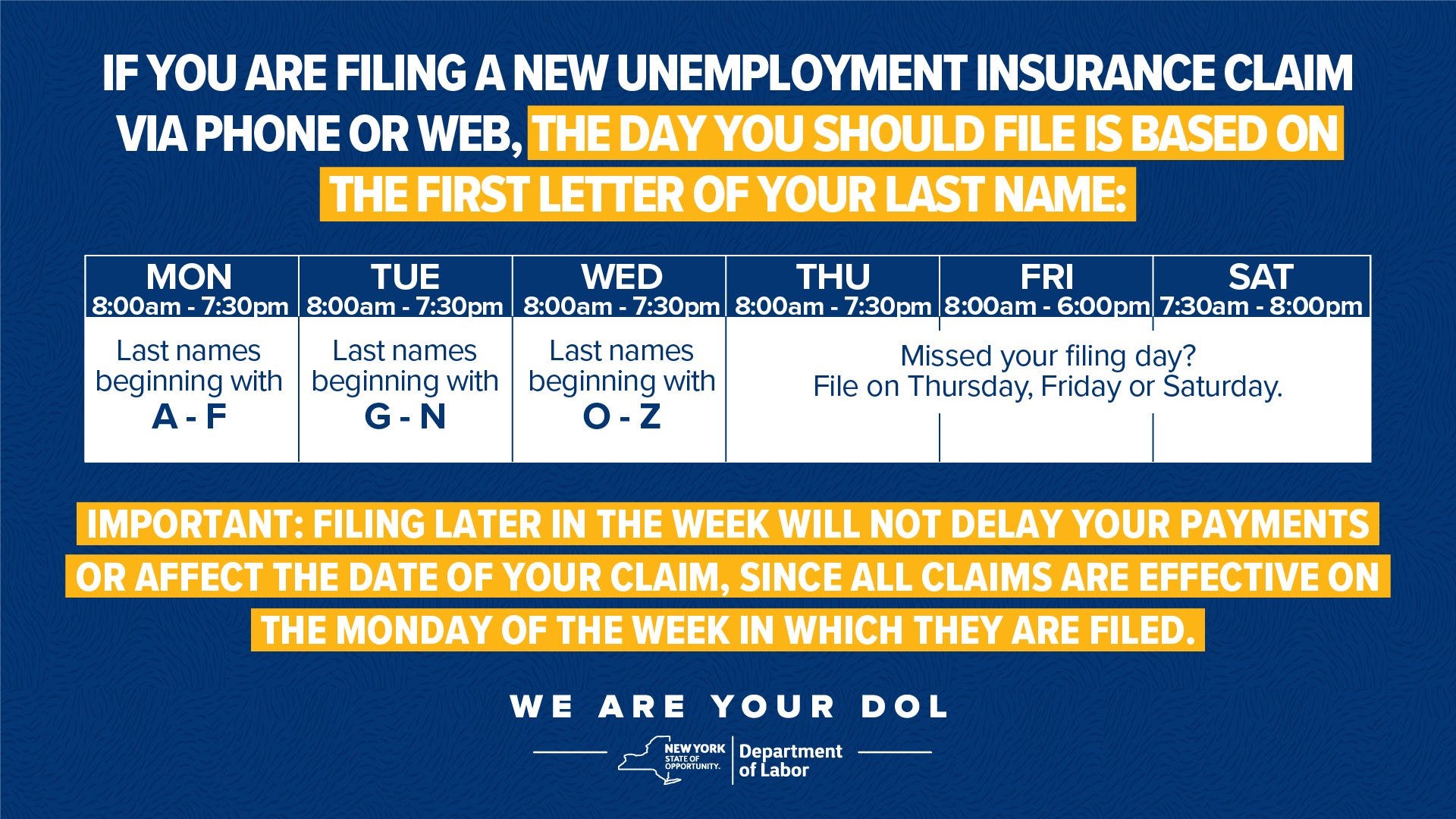

You must report EWF benefits when you file your federal and state income tax returns.

. How do I apply for an New York State Tax Debt installment agreement over the telephone. We may have filed the. Section 171-v of the New York State Tax Law allows NYS to suspend the drivers licenses of individuals who owe 10000 or more in back taxes.

There are a lot of factors that could effect your tax amount due from year to year. Offering skillful advice and relentless representation Brinen Associates provides critical guidance for clients regarding a wide variety of tax matters at both the state and federal levels. February 17 2021 551 PM.

Select the tax year for the refund status you want to check. Remote Workers May Owe New York Income Tax Even If They Havent Set Foot in the State By Jennifer Prendamano James Jay M. If you also have employees you must withhold income tax.

Included in that print out should be filing instructions along with a payment voucher. The Employer Compensation Expense Program ECEP established an optional employer compensation expense tax ECET that employers can elect to pay if they have employees. Enter your Social Security number.

6 hours agoThe cash win is 9976 million but only 24 is withheld and sent to the IRS. Enter the amount of the. With the exception of three states Mississippi North Carolina and Indiana that have decided to levy state taxes on federal student loan forgiveness and several others.

New York State delinquent taxpayers. But since tax rates go up to 37 you owe another 13a whopping 129688000 on April 15. What is my tax account balance.

Some of the most common reasons to owe state tax. If you dont remit the sales tax to New York State you will be assessed for the sales tax that the business was required to collect. If you do not meet the requirements to be a resident you may still owe New York tax as a nonresident if you have income from New York sources.

6 Steps to Check if You Owe State Taxes Checking whether you owe state taxes will depend on your location. October 1 2021 The onset. 3078 - 3876 in addition to state tax Sales tax.

Choose the form you filed from the drop-down menu. If you were a resident for. The amount of New York State withholding in Box 11.

New York State Tax Quick Facts. If you are e-filing your return. New York state income tax rates are 4 45 525 59 597 633 685 965 103 and 109New York state income tax rates and tax brackets.

There are a few ways to apply for a payment plan with New York. There is no fee for this service. New York state income tax brackets and income tax rates depend on.

The NYS Department of Taxation and Finance told the. Each month we publish lists of the top 250 individual and business tax debtors with outstanding tax warrants. This amount is cumulative of the.

If you did not set up a direct payment plan while completing your New York State tax return in. Your tax account balance is the total amount you paid throughout the year toward the tax on the income you made. The safest and easiest way to pay your bill is with an Electronic Funds Transfer directly from your bank to New York State.

According to Bloomberg that means up to 685 in state taxes may be owed in New York next April. If you have your.

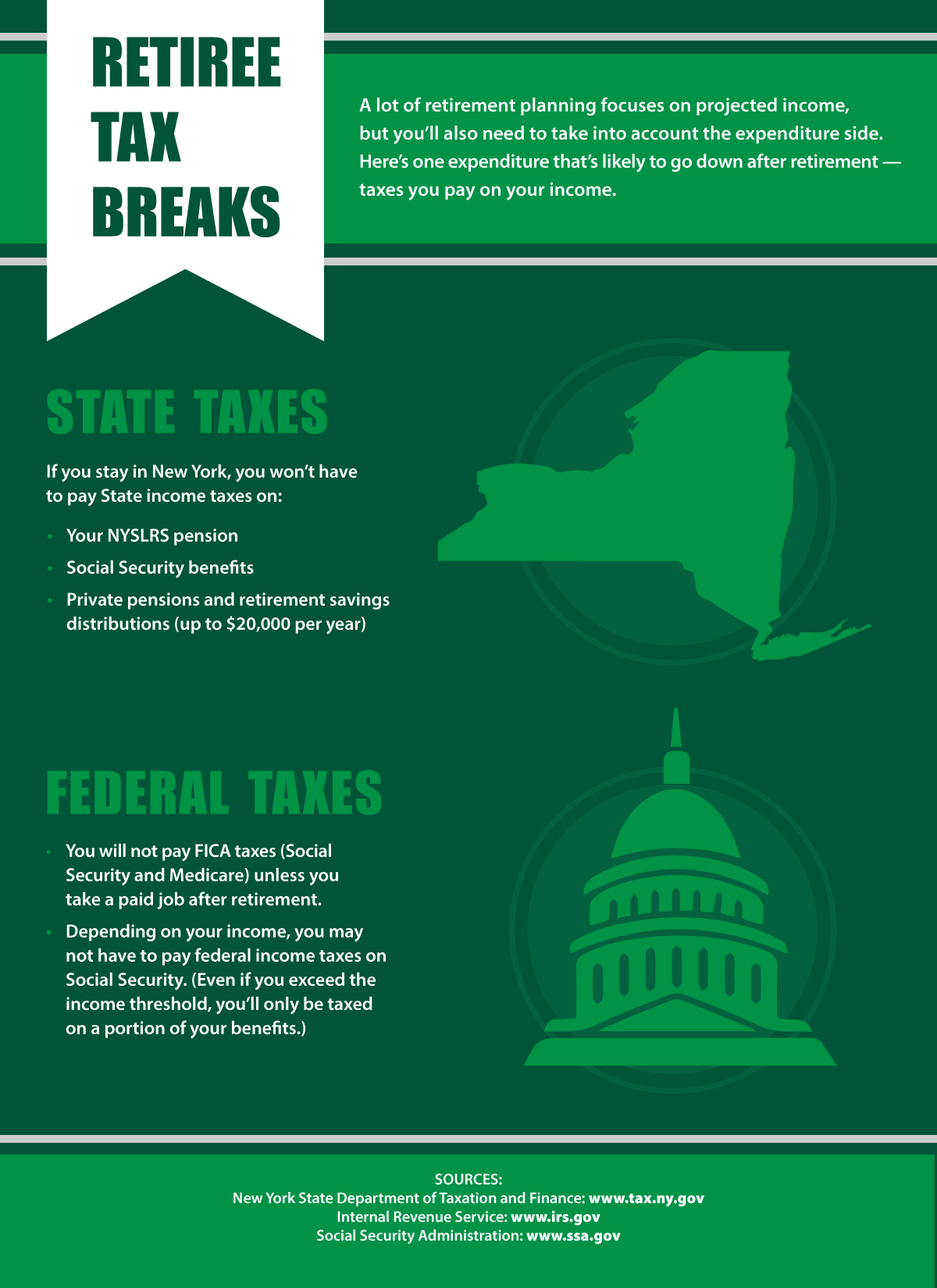

How Come Turbo Tax Keeps Telling Me I Owe State Taxes When Nys Does Not Tax Any Of My Retirement Income Since It All Comes From Nys Retirement And Ss

Nyc S Top Deadbeats State Says These Businesses Owe Millions In Taxes New York City Ny Patch

New York State Taxes For Small Businesses An Overview Bench Accounting

New York Dtf 960 E Letter Sample 2

These Staten Island Businesses Combined Owe 18 3m In Delinquent Taxes To The State Silive Com

State Taxes On Capital Gains Center On Budget And Policy Priorities

New York Taxes Layers Of Liability Cbcny

New York Income Tax Calculator Smartasset

New York State Mistake Panics Taxpayers

Taxes After Retirement New York Retirement News

New York Budget Gap Options For Addressing New York Revenue Shortfall

Paying Taxes In 2022 What You Need To Know The New York Times

New York State Tax Bill Sample 2

Beware Of The Unemployment Benefit Tax Bite What You Need To Know

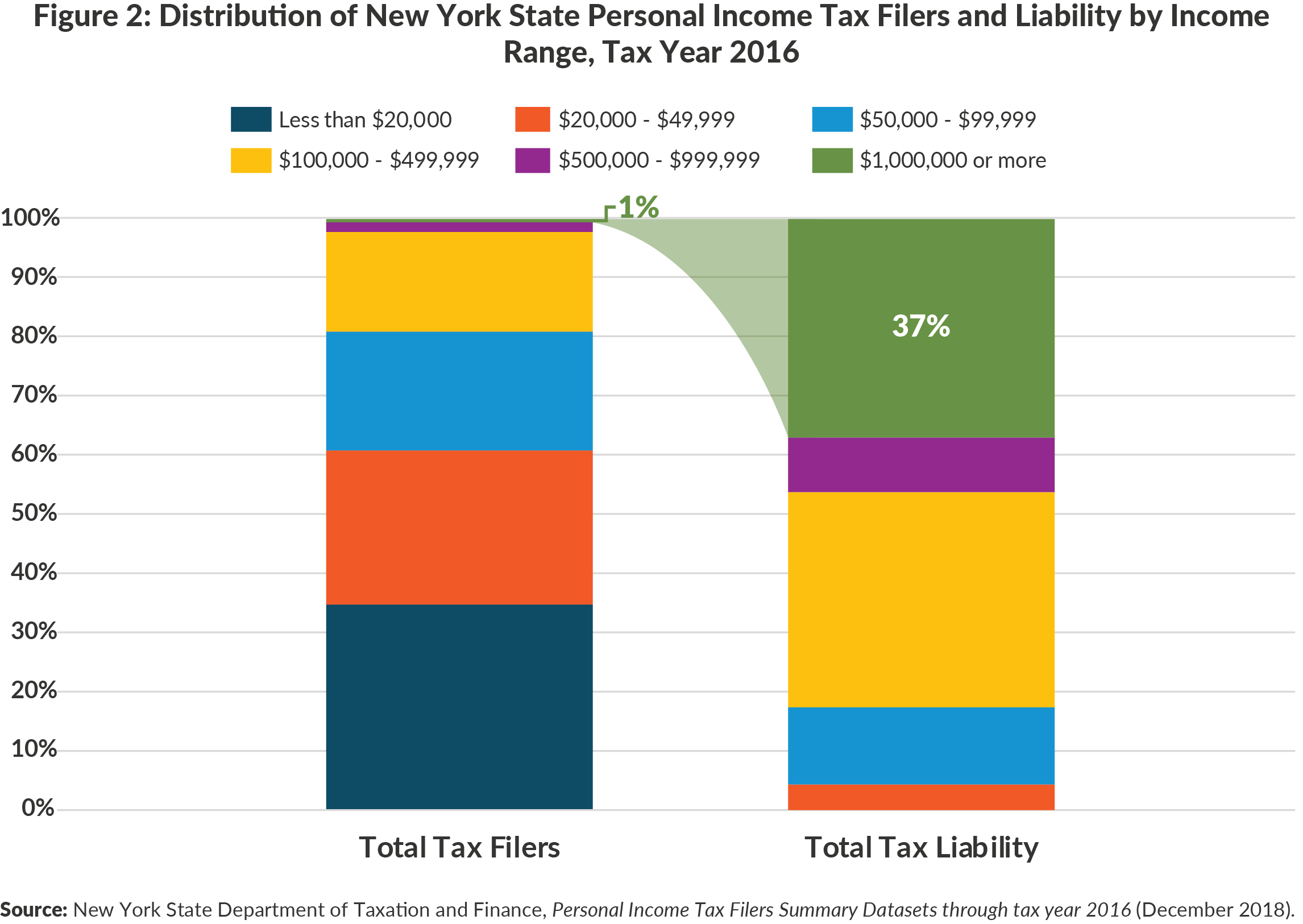

Personal Income Tax Revenues In New York State And City Cbcny

How Come Turbo Tax Keeps Telling Me I Owe State Taxes When Nys Does Not Tax Any Of My Retirement Income Since It All Comes From Nys Retirement And Ss

Ny Budget How Your Income Taxes May Change Under Cuomo S Plan

How Do State And Local Corporate Income Taxes Work Tax Policy Center